Evolution of Portfolio Theory – From Efficient Frontier to CAL to SML (For CFA® and FRM® Exams)

Similar Tracks

Efficient Frontier and Portfolio Optimization Explained | The Ultimate Guide

Ryan O'Connell, CFA, FRM

The Arbitrage Pricing Theory and Multifactor Models of Risk and Return (FRM P1 2025– Bk 1 – Chptr 6)

AnalystPrep

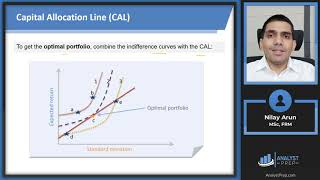

Investors utility and Capital Allocation Line (CAL) - Portfolio Risk and Return : Part One

Ekeeda - Commerce and Management

Modern Portfolio Theory (MPT) and the Capital Asset Pricing Model (CAPM) (FRM P1 2025 – B1 – Ch5)

AnalystPrep